Table of Contents

- Radio Profile | Historic US inflation impacts world markets - World ...

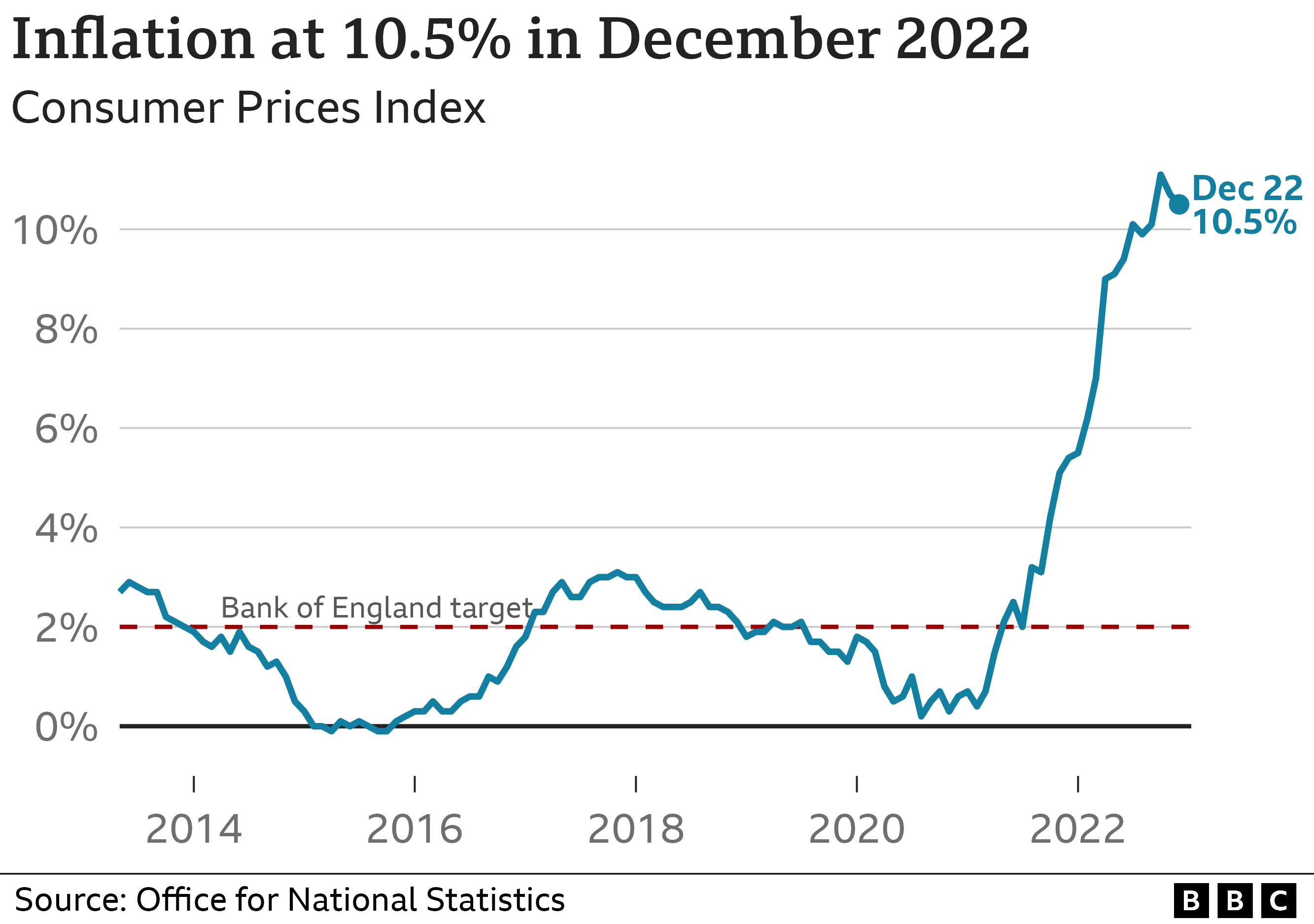

- UK inflation drops but food keeps inflation high - BBC News

- Inflation — Riksbanken prickar rätt - inflationen i linje med prognoserna

- Japan Inflation Rate July 2024 To June 2024 - Nissa Leland

- What to know about surging inflation in US - Good Morning America

- April CPI report may show little, if any, progress in slowing inflation ...

- A slowdown in US inflation eases some pressure on households | AP News

- Inflation increases to 3.2% as Americans hit with higher prices in ...

- US inflation likely cooled again last month as Fed prepares to assess ...

- Live news updates from October 13: US inflation comes in at 8.2% ...

The decrease in inflation can be attributed to a decline in the prices of goods such as food, housing, and apparel. The food index, which accounts for a significant portion of the CPI, increased by 0.4% in February, which is a slower pace than the 0.5% increase reported in January. The housing index, which includes rent and utilities, also rose by 0.8%, a slower pace than the 0.9% increase in January.

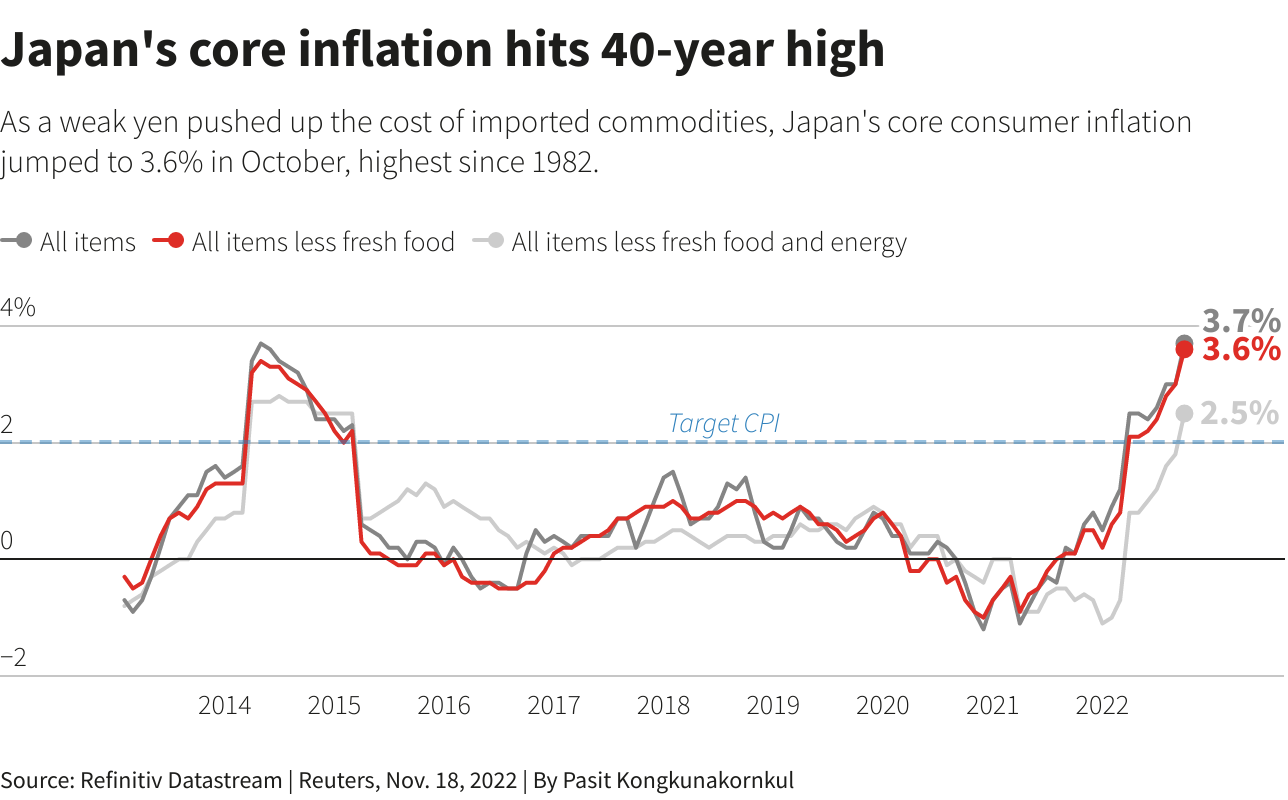

Core Inflation Rate

The easing of inflationary pressures has been welcomed by investors and consumers alike. The stock market has responded positively to the news, with the Dow Jones Industrial Average and the S&P 500 index rising by over 1% in the aftermath of the announcement. The decrease in inflation has also led to a decrease in the yield on the 10-year Treasury bond, which has fallen to its lowest level in several months.

Implications for Monetary Policy

The decrease in inflation has also sparked hopes that the economy may be entering a period of sustained growth. The US economy has been experiencing a slowdown in recent months, with the GDP growth rate slowing to 2.1% in the fourth quarter of last year. However, with the inflation rate easing, the economy may be poised for a rebound. The decrease in inflation has also led to an increase in consumer confidence, which is a key driver of economic growth.

In conclusion, the easing of inflation in February is a positive sign for the US economy. The decrease in the consumer price index and the core inflation rate suggests that the inflationary pressures may be easing, and that the economy may be returning to a more stable growth path. The implications of this trend are significant, and could lead to a decrease in interest rates, an increase in consumer confidence, and a rebound in economic growth. As the US economy continues to evolve, it will be important to monitor the inflation rate and other economic indicators to determine the best course of action for monetary policy.Overall, the news that US inflation eased more than expected in February is a welcome development for consumers, businesses, and investors. It suggests that the economy may be entering a period of sustained growth, and that the inflationary pressures may be easing. As the economy continues to grow and evolve, it will be important to monitor the inflation rate and other economic indicators to determine the best course of action for monetary policy.