Table of Contents

- Ex-Fannie Mae Chief Is Dismissed From Investors’ Suit - The New York Times

- Fannie Mae Announces Priscilla Almodovar As Chief Executive Officer

- Fannie Mae Guidelines for the Appraiser

- Fannie Mae Prepares for Possible Losses on Multifamily Loans This Year

- Fannie Mae Offers Affordability Incentives for Multifamily Borrowers ...

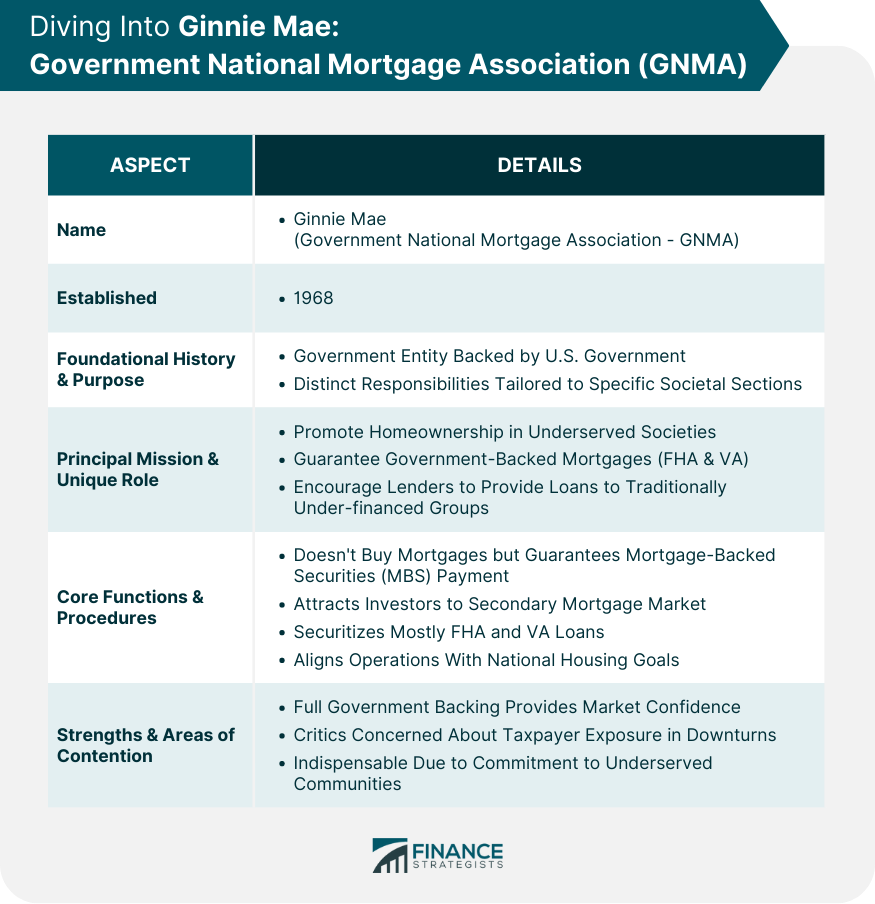

- Fannie Mae vs Freddie Mac vs Ginnie Mae | Finance Strategists

- What is the Difference Between Freddie Mac and Fannie Mae? - Willowdale ...

- New Fannie Mae HQ to transform DC office block (Photos) | WTOP

- Fannie Mae Corrects Its Title Insurance Pilot Program Mistake ...

- Fannie Mae logo in transparent PNG and vectorized SVG formats

What is Fannie Mae?

How Does Fannie Mae Operate?

Benefits of Fannie Mae

The benefits of Fannie Mae's operations are multifaceted: Affordable Housing: By providing liquidity to the mortgage market, Fannie Mae enables lenders to offer competitive interest rates and terms, making housing more affordable for borrowers. Increased Access to Credit: Fannie Mae's guarantee helps to reduce the risk for lenders, allowing them to extend credit to a broader range of borrowers, including those with lower credit scores. Stability in the Mortgage Market: Fannie Mae's presence in the mortgage market helps to maintain stability, even in times of economic uncertainty. In conclusion, Fannie Mae plays a vital role in the US housing market, providing essential liquidity and stability to the mortgage industry. By understanding how Fannie Mae operates and the benefits it offers, borrowers and lenders can better navigate the complex world of mortgage financing. As a government-sponsored enterprise, Fannie Mae continues to support the American dream of homeownership, making it possible for millions of individuals and families to achieve their housing goals.For more information on Fannie Mae and its operations, visit Fannie Mae's official website. Whether you're a borrower, lender, or investor, staying informed about the mortgage market and the role of Fannie Mae can help you make informed decisions and achieve your financial objectives.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial expert before making any investment decisions.