JPMorgan Chase & Co. (JPM) is one of the largest and most renowned financial institutions in the world, offering a wide range of financial services to individuals, corporations, and governments. As a leading player in the banking and financial sector, JPMorgan Chase's stock price is closely watched by investors and market analysts. In this article, we will provide an overview of JPMorgan Chase & Co.'s stock price and performance, as well as delve into the company's history, business segments, and future prospects.

Company Overview

JPMorgan Chase & Co. was founded in 1877 and is headquartered in New York City. The company is a multinational bank and financial services provider, operating in over 100 markets worldwide. JPMorgan Chase's business segments include Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management. The company is led by CEO Jamie Dimon, who has been at the helm since 2005.

Stock Price Performance

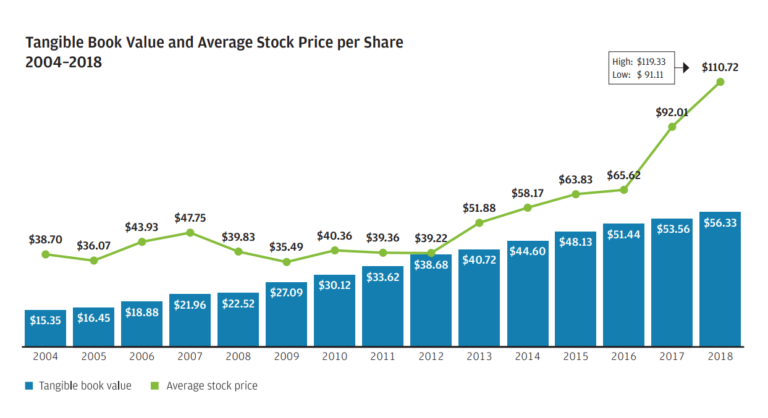

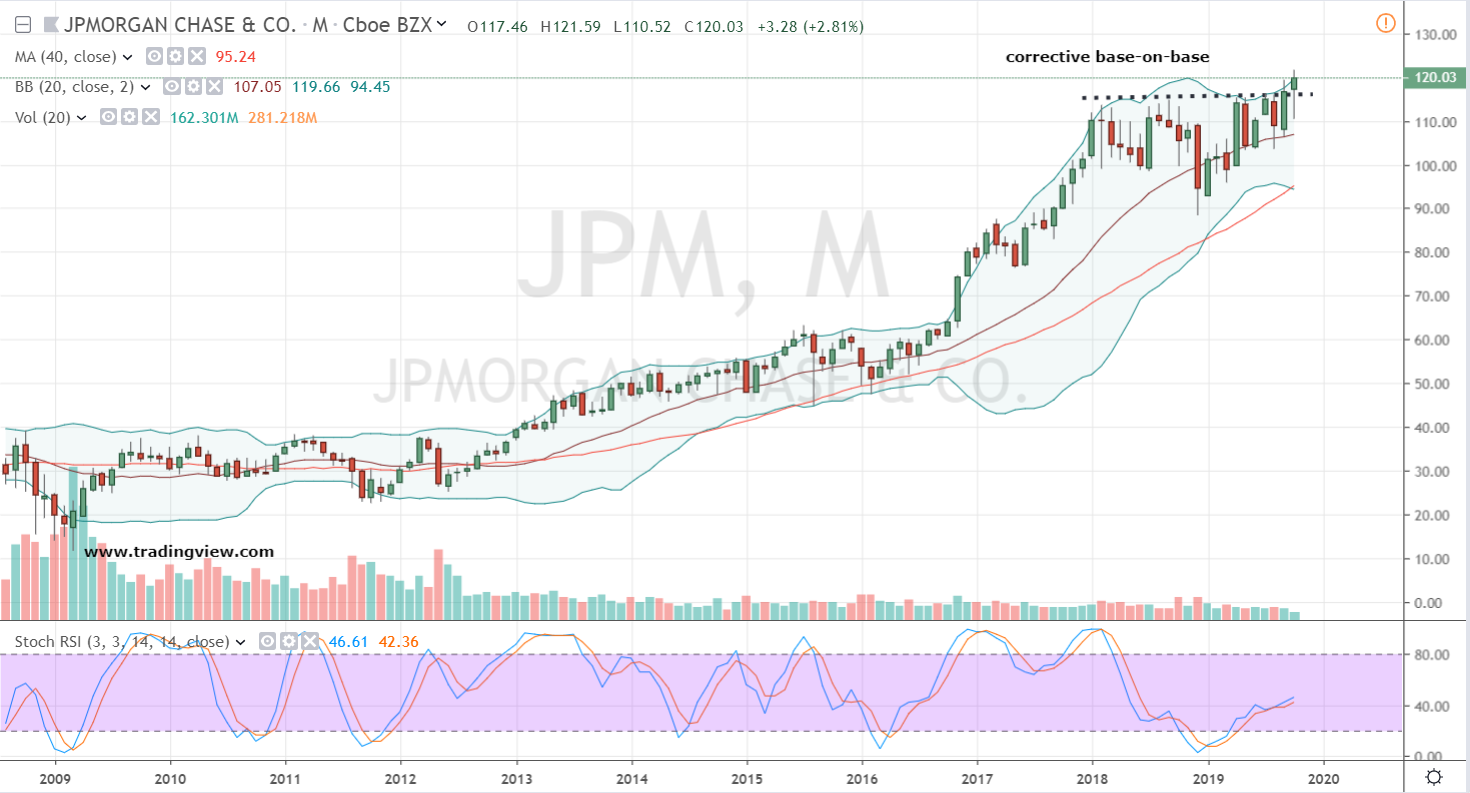

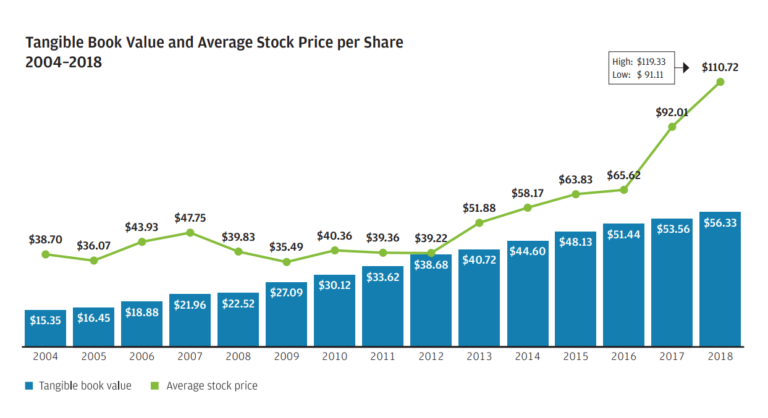

JPMorgan Chase's stock price has been a subject of interest for investors in recent years. The company's stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol JPM. As of the latest trading session, JPMorgan Chase's stock price is around $120 per share, with a market capitalization of over $400 billion. The stock has shown significant growth over the past few years, with a 5-year return of over 50%.

Key Performance Indicators

Some of the key performance indicators that investors look at when evaluating JPMorgan Chase's stock include:

Revenue Growth: JPMorgan Chase's revenue has grown steadily over the years, with a 5-year compound annual growth rate (CAGR) of 5%.

Net Income: The company's net income has also shown significant growth, with a 5-year CAGR of 10%.

Return on Equity (ROE): JPMorgan Chase's ROE is around 12%, which is higher than the industry average.

Dividend Yield: The company's dividend yield is around 3%, which is attractive to income-seeking investors.

Future Prospects

JPMorgan Chase is well-positioned for future growth, driven by its diversified business segments and strong brand reputation. The company is investing heavily in digital transformation, with a focus on mobile banking, online lending, and data analytics. Additionally, JPMorgan Chase is expanding its presence in emerging markets, particularly in Asia and Latin America.

Risks and Challenges

However, JPMorgan Chase also faces several risks and challenges, including:

Regulatory Risks: The company is subject to strict regulatory requirements, which can impact its business operations and profitability.

Competition: The banking and financial sector is highly competitive, with many established players and new entrants vying for market share.

Economic Uncertainty: Economic downturns and market volatility can impact JPMorgan Chase's revenue and profitability.

In conclusion, JPMorgan Chase & Co. (JPM) is a well-established financial institution with a strong track record of performance. While the company faces several risks and challenges, its diversified business segments, strong brand reputation, and commitment to digital transformation position it for future growth. Investors looking to invest in the banking and financial sector may want to consider JPMorgan Chase's stock, given its attractive dividend yield and potential for long-term growth. As with any investment, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.