As the landscape of retirement savings continues to evolve, individuals nearing or in retirement are keenly interested in maximizing their savings. One significant aspect of this strategy involves catch-up contributions, which allow workers aged 50 and above to contribute more to their retirement accounts than the standard limits. However, with changes on the horizon, particularly those set to take effect in 2026, it's crucial to understand what these modifications mean for retirement planning. In this article, we'll delve into the key questions surrounding catch-up contributions in 2026 and explore how these changes will impact your ability to save for retirement.

What are Catch-Up Contributions?

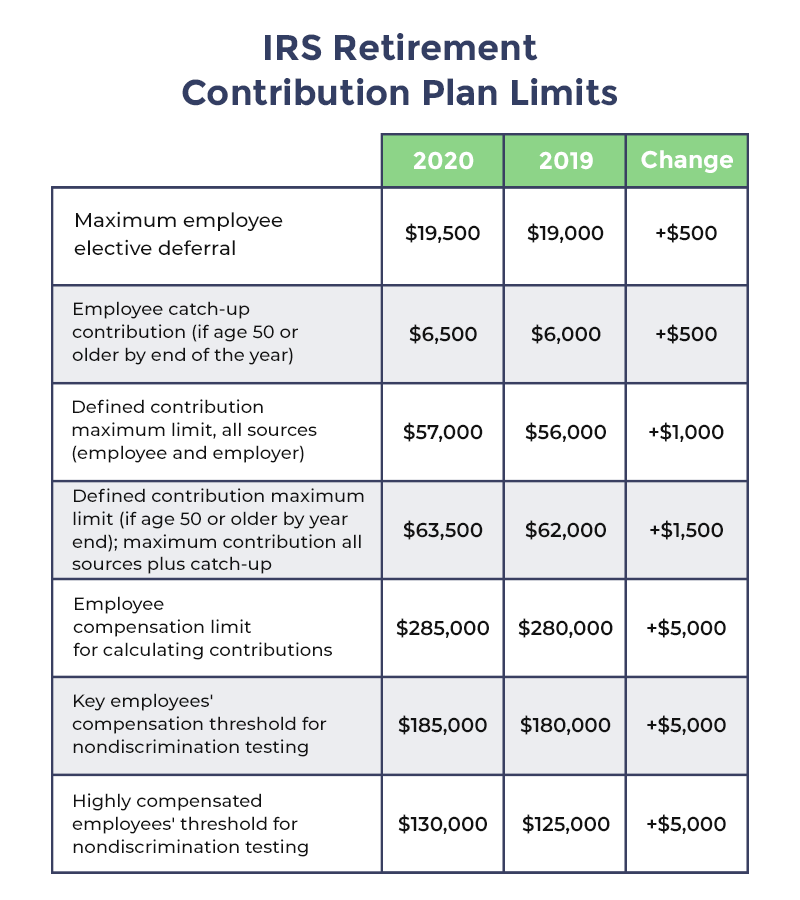

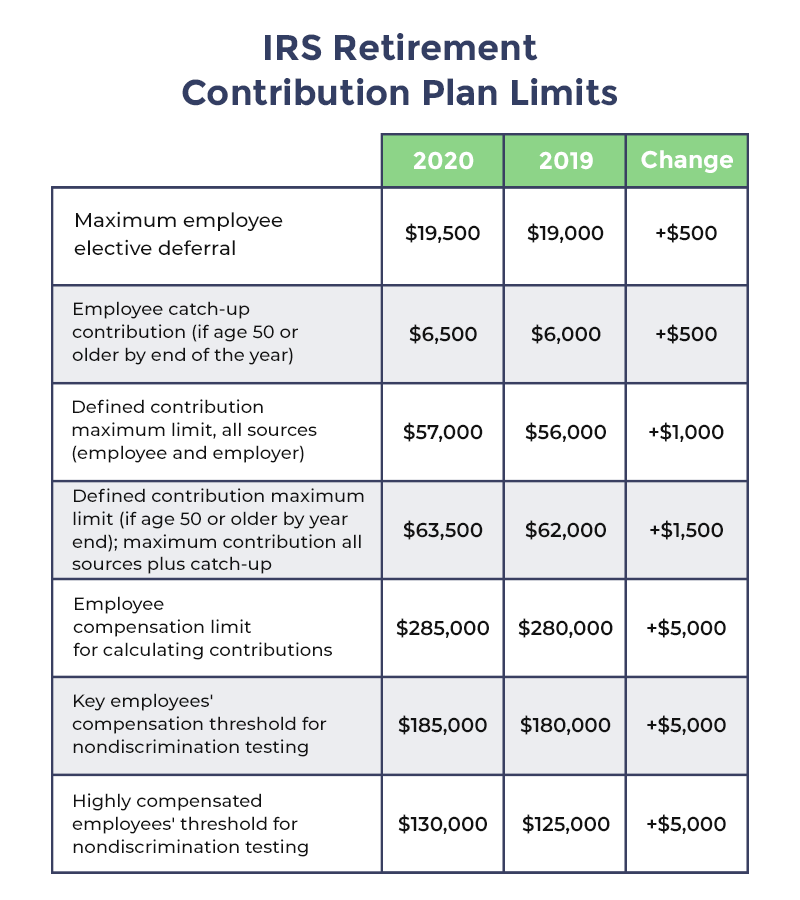

Catch-up contributions are additional amounts that individuals aged 50 and older can contribute to their retirement accounts, such as 401(k), 403(b), and IRA accounts. These contributions are designed to help older workers boost their retirement savings as they approach retirement age. For instance, in 2023, the standard contribution limit for a 401(k) account is $22,500, but individuals 50 and older can contribute an additional $7,500, bringing their total contribution limit to $30,000.

What Changes are Coming in 2026?

In 2026, several changes to catch-up contributions are slated to take effect, primarily aimed at adjusting income limits and potentially altering the after-tax nature of these contributions for higher-income individuals. One of the significant changes involves requiring catch-up contributions to be made on an after-tax (Roth) basis for individuals with incomes above certain thresholds. This means that instead of deducting these contributions from their taxable income, higher-income earners will contribute after-tax dollars, which can then grow tax-free and be withdrawn tax-free in retirement.

Key Questions About the Changes

-

Who Will Be Affected by the Changes? The changes will primarily affect higher-income individuals who previously benefited from making pre-tax catch-up contributions.

-

How Will the Changes Impact Retirement Savings Strategies? The shift towards after-tax contributions for higher-income earners may lead to a reevaluation of retirement savings strategies, potentially favoring Roth accounts over traditional pre-tax accounts for some individuals.

-

What Are the Implications for Tax Planning in Retirement? The changes could have significant implications for tax planning in retirement, as they may influence the decision to convert traditional IRA funds to Roth IRAs or to prioritize Roth contributions over traditional contributions.

Planning Ahead: Strategies for Maximizing Catch-Up Contributions

Despite the upcoming changes, catch-up contributions remain a powerful tool for boosting retirement savings. Here are a few strategies to consider:

-

Start Early: Even with the changes, starting to make catch-up contributions as soon as you're eligible can significantly impact your retirement savings over time.

-

Diversify Your Retirement Accounts: Consider contributing to both traditional and Roth accounts to optimize your tax situation in retirement.

-

Consult a Financial Advisor: Given the complexity of retirement planning and the impact of the changes, seeking professional advice can help tailor your strategy to your specific financial situation and goals.

In conclusion, the changes to catch-up contributions set to take effect in 2026 will undoubtedly impact how individuals approach retirement savings, particularly for those in higher income brackets. By understanding these changes and adapting your retirement savings strategy, you can continue to maximize your contributions and work towards a more secure financial future. Whether you're nearing retirement or just starting to plan, staying informed about these developments is crucial for making the most of catch-up contributions and achieving your long-term financial goals.

_and_Roth_IRA_Plans.png?width=3840&name=Things_to_Consider_Before_Maxing_Out_401(k)_and_Roth_IRA_Plans.png)