Table of Contents

- Irmaa Brackets 2025 Part B - Ameen Sanaa

- Possible IRMAA 2025 Brackets

- The IRMAA Brackets for 2023 - Social Security Genius

- 2025 Irmaa Brackets Married Jointly 2024 - Trula Ingaborg

- Irmaa Brackets For 2025 - Mirna Alejandrina

- 2025 Irmaa Brackets Based On 2025 Income 2025 - Zihna Skye

- Medicare Irmaa Brackets For 2025 Images References : - Isadora Blake

- 2025 Irmaa Brackets Part B - Megan Butler

- Irmaa Brackets 2024- 2024 2025 - Gwenny Jenilee

- 2025 Medicare Part B Irmaa Premium Brackets 2025 - Morteza Harrison

What is IRMAA?

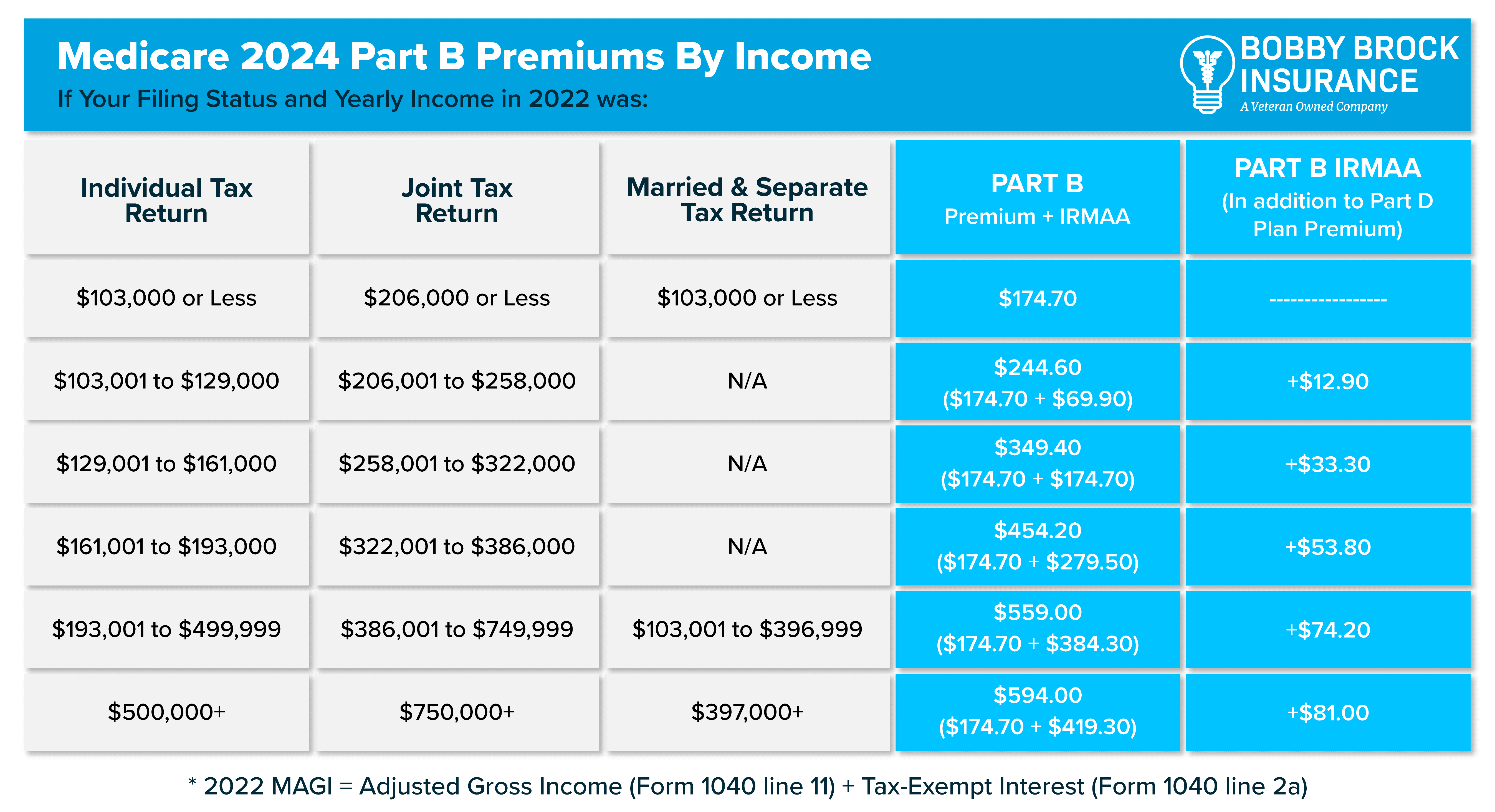

2025 IRMAA Brackets and Rates

How IRMAA Works

The IRMAA is calculated based on the beneficiary's modified adjusted gross income (MAGI) from two years prior. For example, the 2025 IRMAA will be based on the beneficiary's 2023 MAGI. The Social Security Administration (SSA) will notify beneficiaries of their IRMAA surcharge amount, which will be added to their Medicare Part B and Part D premiums.

Impact on Medicare Beneficiaries

The 2025 IRMAA changes will affect Medicare beneficiaries with higher incomes, who will see an increase in their Part B and Part D premiums. However, beneficiaries with lower incomes will not be affected by the IRMAA surcharge. It is essential for Medicare beneficiaries to review their income and adjust their budget accordingly to ensure they can afford their Medicare premiums. In conclusion, the 2025 Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an essential aspect of the Medicare program that affects beneficiaries with higher incomes. Understanding the IRMAA brackets and rates, as well as how it works, can help Medicare beneficiaries plan for their healthcare costs and make informed decisions about their coverage. If you have any questions or concerns about the 2025 IRMAA, it is recommended that you consult with a licensed insurance agent or contact the Social Security Administration for more information.Keyword: 2025 Medicare Income-Related Monthly Adjustment, IRMAA, Medicare Part B, Medicare Part D, Medicare premiums, Social Security Administration.