Table of Contents

- This Is Why the Uber Stock Bears and Bulls Are Still In a Holding ...

- Uber Stock: On Fast Track After First Profits | Investor's Business Daily

- Uber tumbles 9% in rocky stock market debut - cnbctv18.com

- UBER - Uber Technologies Inc Stock Price Forecast 2025, 2026, 2030 to ...

- UBER Stock Price and Chart — TradingView

- Uber Technologies Stock Slides as Earnings Fall Short of Expectations ...

- Uber Stock: Is It A Buy As It Eyes First Profitable Quarter? | Investor ...

- Uber Stock (NYSE:UBER): Catch a Ride, but Not at This Price

- Uber Stock Name: What Is It and When Will Uber Go Public?

- UBER Stock Price and Chart — TradingView

Current Stock Price and Performance

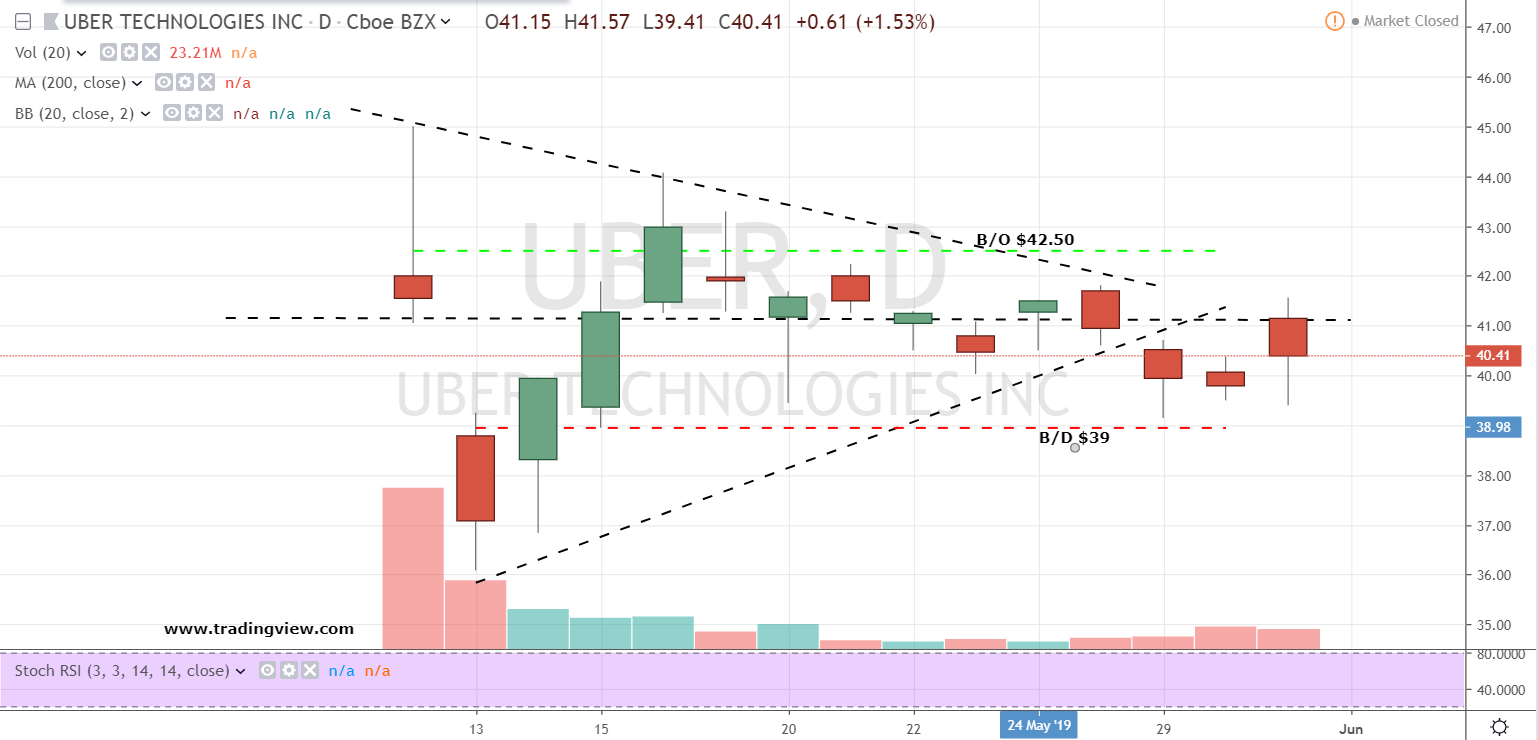

Historical Trends and Volatility

One of the key factors contributing to Uber's stock price volatility is the company's ongoing battle for market share in the ride-hailing industry. The company faces intense competition from rivals such as Lyft, Inc. (LYFT) and Via Transportation, Inc. However, Uber's diversified services and strategic partnerships have helped the company maintain its market lead.

Financial Performance and Growth Prospects

Uber's financial performance has been a subject of interest for investors, with the company reporting significant revenue growth in recent quarters. In its latest earnings report, Uber posted a revenue of $4.1 billion, representing a 24% increase year-over-year. The company's net loss narrowed to $1.1 billion, down from $2.9 billion in the same period last year.Looking ahead, Uber's growth prospects appear promising, driven by its expanding services and strategic investments. The company's food delivery business, Uber Eats, has been a significant contributor to revenue growth, with the company reporting a 63% increase in food delivery gross bookings. Additionally, Uber's investments in autonomous driving technologies and freight services are expected to drive long-term growth and profitability.

Analyst Estimates and Recommendations

Wall Street analysts have been bullish on Uber's stock, with a consensus rating of "Buy" and a target price of $45 per share. Analysts cite the company's diversified services, expanding market share, and improving profitability as key drivers of growth. However, some analysts have raised concerns over the company's regulatory risks and competition in the ride-hailing industry.In conclusion, Uber's stock analysis presents a complex picture, with both opportunities and challenges on the horizon. While the company's expanding services and improving profitability are positives, regulatory risks and competition remain concerns. As the company continues to navigate the ever-changing landscape of the ride-hailing industry, investors will be closely watching Uber's stock price and financial performance.

For investors looking to buy or sell Uber stock, it's essential to conduct thorough research and analysis, considering both the company's historical trends and future prospects. With its diversified services and strategic investments, Uber Technologies, Inc. (UBER) remains a stock to watch in the technology and transportation industries.