Table of Contents

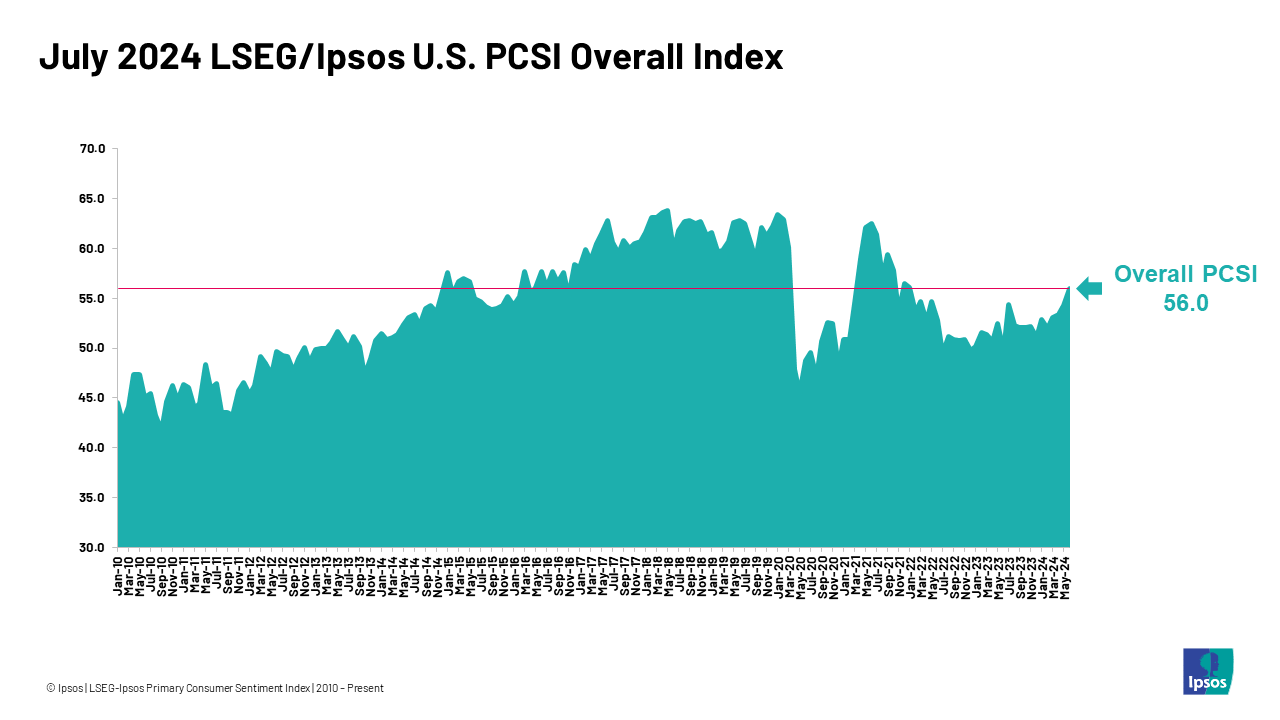

- July 2024 LSEG/Ipsos Primary Consumer Sentiment Index | Ipsos

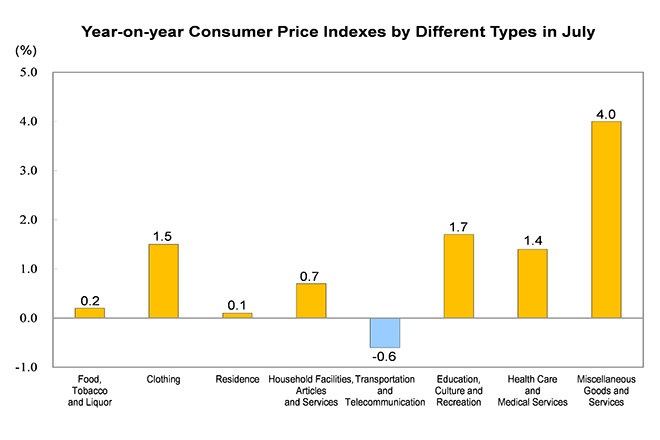

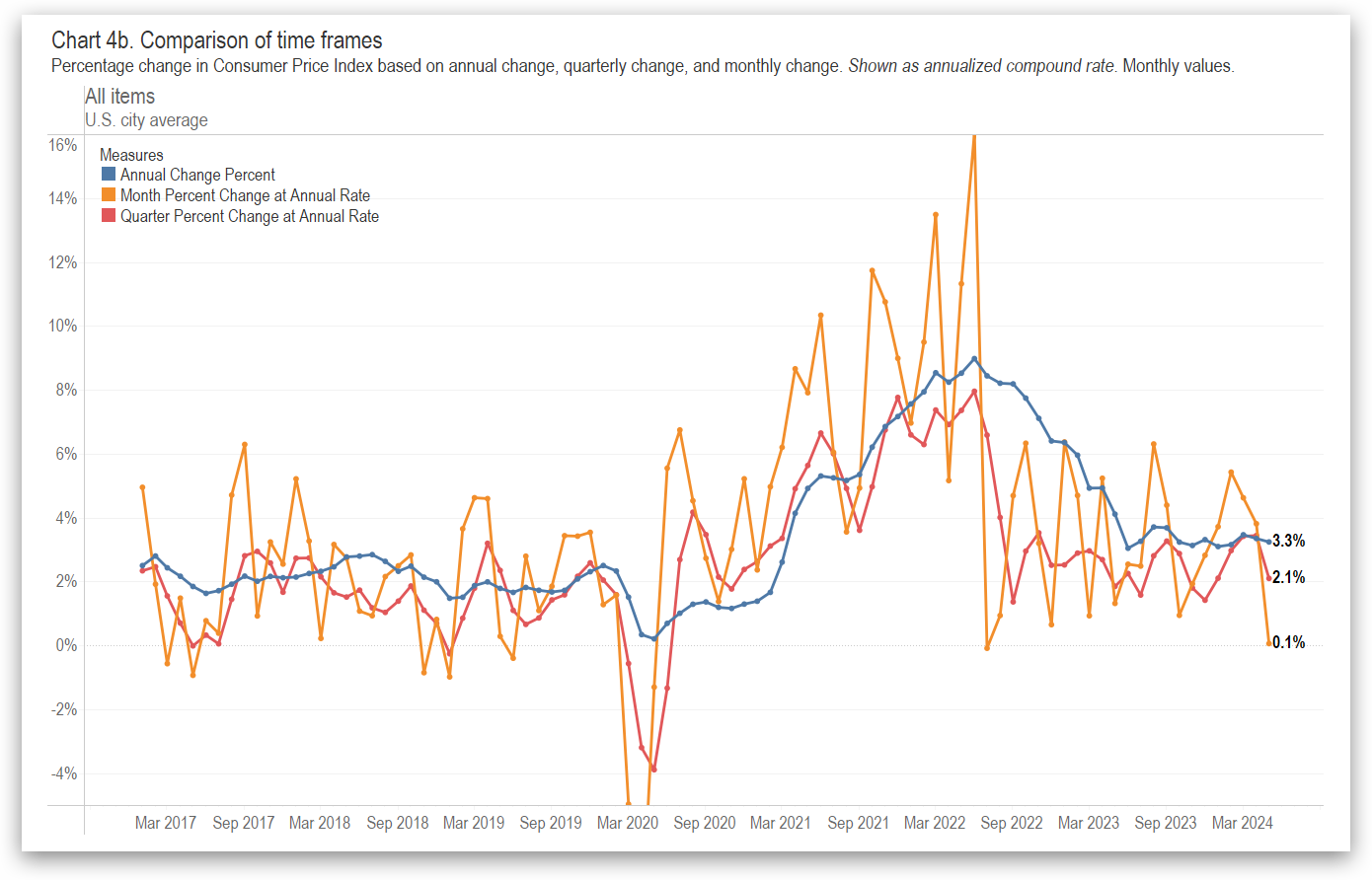

- Consumer Price Index for July 2024

- Consumer Price Index (CPI) for September 2024 is Projected to Rise 2.3% ...

- Consumer Price Index, May 2024

- Group

- The Daily — Consumer Price Index, September 2024

- Group

- CONSUMER PRICE INDEX – June 2024 - Fiji Bureau of Statistics

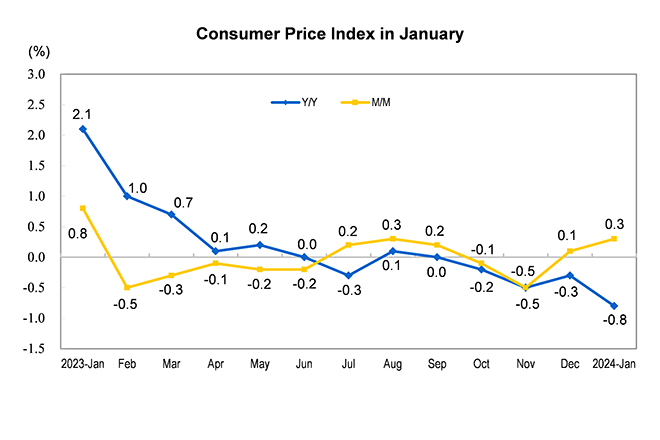

- Consumer Price Index for January 2024

- Consumer Price Index for February 2024

What is the Consumer Price Index (CPI)?

April 2024 Consumer Price Index: Key Highlights

Insight/2024/10.2024/10.09.2024_CPI/02-consumer-price-index-median-estimate-12-months.png?width=2016&height=1152&name=02-consumer-price-index-median-estimate-12-months.png)

Implications for the Forex Market

The Consumer Price Index has significant implications for the forex market. A higher-than-expected CPI reading can lead to: Increased interest rates: To combat inflation, central banks may raise interest rates, making borrowing more expensive and increasing the attractiveness of a currency. Currency appreciation: A strong CPI reading can lead to an appreciation of the currency, as investors seek higher returns in countries with rising interest rates. Volatility: CPI releases can be a major market-moving event, leading to increased volatility in the forex market.

Trading Strategies for the April 2024 CPI Release

Forex traders can use the following strategies to trade the April 2024 CPI release: Buy the rumor, sell the fact: If the market expects a high CPI reading, prices may already be factored in. Traders can buy the currency before the release and sell it after the fact, profiting from the potential reversal. Range trading: Traders can identify key support and resistance levels and trade the range, taking advantage of the potential volatility surrounding the CPI release. Trend following: If the CPI reading confirms a trend, traders can follow the trend, buying or selling the currency accordingly. The April 2024 Consumer Price Index is a critical economic indicator that can have significant implications for the forex market. By understanding the CPI and its potential impact on interest rates, currency values, and volatility, traders can make informed trading decisions. Whether you're a beginner or an experienced trader, it's essential to stay up-to-date with the latest economic news and analysis to navigate the complex world of forex trading.Stay ahead of the curve with the latest forex news and analysis from Forex Factory. Visit Forex Factory today to stay informed and make informed trading decisions.